Tax consequences of borrowing to purchase investments

Gearing of investments can generally be classified as follows:

Negative Gearing

The term ‘Negative Gearing’ means that the expenses (both cash & non-cash items) relating to an investment are greater than the income received from the investment, generating a loss. This loss is then offset against your ordinary income which, in turn, reduces your overall taxable income and your income tax liability.

Neutral Gearing

The term ‘Neutral Gearing’ applies when the expenses relating to an investment are equal to the income received. Your investment may be neutral from a cash perspective but still result in a deduction in your income tax return due to non-cash expenses. Refer to the rental property example below which illustrates this result.

Positive Gearing

‘Positive Gearing’ refers to a situation where the income from an investment is greater than its related expenses. This income is added to the other items in your tax return which increases your taxable income and, consequently, your income tax liability

If your investment is negatively geared, it is important to consider the capital growth of the asset. Whilst the ability to deduct investment losses from your taxable income can be valuable, unless those losses are offset against capital growth from the investment, overall you will be faced with an investment loss.

OWNERSHIP

Before you purchase an investment it is important to consider the ownership options and in what name the asset will be held – E.g. Husband and Wife (I.e. Tenants in Common or Joint tenancy), Individually, Trust, Superannuation Fund, Company or a joint ownership between entities. The ownership of investments is very important for the following reasons:

- The ownership option you choose will impact who receives the benefit of the negative gearing. You can only declare the income you earn and claim the related expenses if your name is on the title deed. For example, if a property is held as joint tenants (E.g. Mr & Mrs Smith) 50% of the income and expenses will be included in each owner’s tax return.

- You may wish to hold the asset in the name of the person with a higher taxable income. By structuring the investment in this way, the deductions generated by a negatively geared asset will have a higher value making the return on the investment greater. Alternatively, holding a positively geared asset in the name of a lower tax paying individual may make sense.

- If asset protection is a priority in your investment strategy, holding the asset in a separate entity may be the best option.

- The split of income and expenses is fixed depending on the ownership, regardless of who ‘pays’ for various expenses.

A common example of a negatively geared asset is an investment property. Below is an outline of some of the common expenses that relate to properties and some issues to consider when entering into this style of investment.

BORROWING

To claim interest against your rental property, the borrowing for the property must be executed correctly. It is the ‘use of the funds’ that determines the deductibility of any loan. There must be a clear path between the drawing of funds and the purchase of a property to ensure the interest on a loan is deductible. This is also important over the life of the loan. Using a redraw facility on a property loan to purchase personal items (e.g. a holiday) will reduce the deductibility of the loan.

Again, the ownership of the property will dictate where the interest can be claimed. If a property is held as joint tenants but the loan is in the name of a single owner, the individual will only be able to claim a 50% share of the interest in line with their ownership percentage.

DEPRECIATION AND CAPITAL WORKS

Some capital costs in relation to rental properties can be written off over time. These include assets such as furniture and fittings as well as some construction costs which are included in your initial purchase cost.

To claim depreciation and capital works deductions it may be worthwhile to obtain a quantity surveyors report which will provide an inventory of the cost of items which can be claimed. Whilst these may seem expensive, they can provide substantial deductions in your return. Capital works and depreciation are also the areas where you can claim any renovations or alterations you make to the property.

Depreciation and Capital Works are examples of non-cash deductions available against rental properties. It represents the deterioration of assets and allows for large items (e.g. ovens) to be deducted over time. They create higher tax deductions without additional cash outlay, however, they do reduce the cost base of the asset over time.

It is important to note that the purchase of assets over $300 will be depreciated according to the tax office rates and cannot be claimed immediately.

REPAIRS AND MAINTENANCE

Repairs and maintenance is also deductible against rental income, however, it is important to distinguish between a repair and an improvement. A repair is a cost incurred in returning a property to its initial state – e.g. replacing a broken window. An improvement is works undertaken to increase the rental return or capital value of a property – e.g. installing shutters on windows. Improvements can be deducted over time via depreciation in your tax return.

TRAVEL

Travel costs to inspect your property are also an allowable deduction. These travel costs will be restricted to the actual costs associated with the inspection of the property. If the inspection coincides with a holiday, only part of the total travel costs will be deductible.

LAND TAX

Land tax may be payable on an investment property and is assessed according to the state the property is located.

The amount of land tax will be calculated based on land value of the property and the ownership interest. For example, a property held individually is assessed differently to a property held by a Family Trust.

EXAMPLE

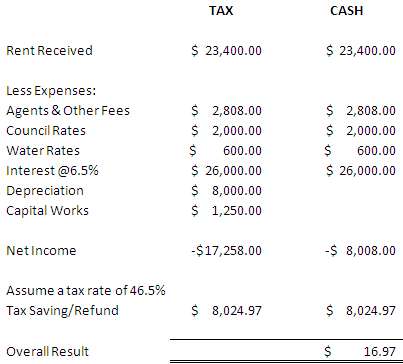

The following example shows the tax deduction and cash effect of holding a rental property purchased for $500,000, collecting rent of $450/week with an associated borrowing of $400,000 at 6.5% interest.

The above are some of the issues involved in the purchase and ownership of an investment property. You should consider the tax implications as well as your long term investment strategy by talking to your Tax Accountant & Financial Adviser before embarking on an investment of this nature.

...............................................

Source: Written by Roger Potter, Director of Wybenga & Partners Pty Limited, Chartered Accountants, Sydney