Solid start to 2012

In Australia, the ASX200 rose 5.1% in January. Resource and Energy stocks were the best performers (all featuring in the ASX20 Top 5 Performers list), whereas the Healthcare index fell 1.2% as investors rotated out of the more defensive names.

While news locally on employment and retail sales came in below expectations, and consumer sentiment only recorded a small rise following two rate cuts at the end of last year, markets were still able to push higher on better news offshore, including a positive growth surprise in China, where GDP grew at 8.9% year on year in the December quarter (versus market expectations of 8.7%). Altogether though, a softening labour market, cautious consumer, and inflation of 2.6% year on year remaining within the mid-point of the Reserve Bank of Australia’s target range, does keep open the likelihood of further rate cuts in Australia.

Meanwhile, US equity markets rose amid improving signs in housing, manufacturing activity, consumer confidence and employment during December. The rally also extended after the Federal Reserve kept policy stimulatory by extending the period over which it will maintain exceptionally low interest rates (to “at least through late 2014”), and speculation re-emerged of further Quantitative Easing. Talk of the latter drove Gold prices up 11%, recovering some of their recent weakness.

Successful bond auctions in Italy and Spain at lower yields than recent history saw sentiment improve in Europe despite credit rating downgrades for several countries and fears of larger debt restructurings to emerge from talks between the Greek Government and private sector bond holders.

So far this year, it appears that our thesis of a stabilisation of credit markets in Europe, a China soft landing and moderate growth in the US is playing out. If this continues, we believe this can lead to a modest improvement in sentiment, valuation and growth expectations.

January Highlights from Research

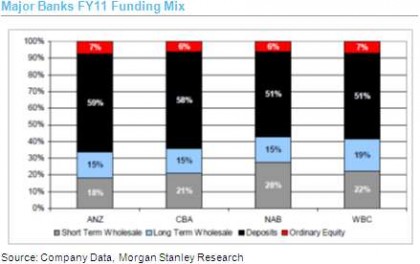

Australian Banks: Profit Downgrades from Higher Funding Costs

Morgan Stanley Research, 20 January 2012

Funding costs have got worse: with the cost of covered bond issues having been far higher than expected. The indicative spread of major bank offshore 5-yr unsecured bond issues have increased by >100 basis points since June. Higher funding costs reduce our FY12 profit forecasts by ~6% on a stand-alone basis, but we expect home loan re-pricing to provide a ~3% offset. However, these factors are already leading to a greater cost focus at the major banks, and we have lowered our expense growth forecasts to reflect this.

Our forecasts now imply broadly flat EPS and dividends this year: We think the major banks can hold dividends under our base case, which assumes no recession over the next two years and just a modest increase in loan losses this year. We see little risk of dividend cuts under the base case scenario because capital positions are healthy and loan growth is modest.

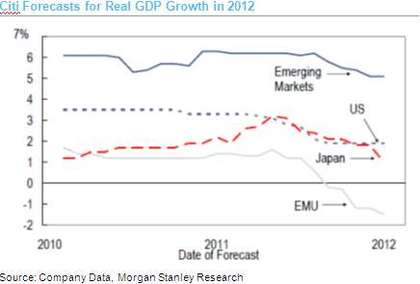

Global Economic Outlook and Strategy - January 2012

Citi Investment Research and Analysis, 18 January 2012

We expect that overall global growth will slow from 3.0% in 2011 to 2.3% in 2012. With extra fiscal tightening announced or expected, plus drag from the weak banking system, we expect that Euro Area Real GDP will fall by 1.5% this year and fall by 0.4% in 2013. By contrast, we still look for US growth of about 2% this year, and gradual improvement in the jobs market. In China, with the domestic property market correction and euro area recession, growth is slowing in early 2012 and may drop to below 8% year on year in the first quarter.

We continue to expect sizeable further debt restructuring in Greece, as well as debt restructuring in Portugal and possibly Ireland. Italy and Spain are likely to need increasing support, probably including some kind of troika program. We continue to expect a long period of very low interest rates across advanced economies. We expect a string of further ratings downgrades for advanced economy sovereign debt, both in coming months and the longer term.

Five Stock Selection Themes for 2012

Morgan Stanley Smith Barney Portfolio Strategy & Research Group, 25 January 2012

We present 5 stock selection themes. From a more bottom-up level, we see some characteristics of the market that may find favour with most equity investors this year, including:

1. Look for Large Caps that are forecast to deliver similar growth to that in the Small Caps sector, but trade on less expensive multiples (e.g. IPL, BLY, SUN, FMG);

2. Reduce exposures to Expensive Defensives, which are not just trading at a premium to the rest of the market, but the premium is also higher than average (e.g. RHC, CCL, COH);

3. Look for quality yield in a low interest rate environment (e.g. NAB, SUN, BKN, ANZ);

4. We think that in the absence of M&A, companies will continue to chip away at share buybacks to utilize any excess cash and deliver mild earnings accretion (e.g. RIO, RMD, SUN, GMG);

5. Undervalued with potential for company transformational growth. A number of companies have continued to evolve over the past 3 years and progressed growth options without seeing this reflected in their share price. If successfully executed, these companies could deliver substantial growth (e.g. AMP, STO).

|

Please contact Lachlan Cameron should you wish to obtain a copy of the full research reports listed or refer to our website at www.morganstanleysmithbarney.com.au. .................................................. Source: Written by Lachlan Cameron, Vice President, Financial Adviser, of Morgan Stanley Smith Barney Pty Limited, Sydney Research sourced from:

Important information This communication is made by Morgan Stanley Smith Barney Australia Pty Ltd (“Morgan Stanley Smith Barney”) (ABN 19 009 145 555, AFSL 240813) a Participant of ASX Group. This communication provides market commentary and strategy ideas to clients of Morgan Stanley Smith Barney and its affiliates (the “Firm”). Such commentary and ideas are based upon generally available information. Although the information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. All opinions and estimates included in this document constitute our judgment as of this date and are subject to change without notice. Any prices used herein are historic unless expressly indicated otherwise and may not be available when any order is entered. Any price indications are not firm bids or offers, either as to price or size, and will not form the basis of or be relied on in connection with any contract or commitment whatsoever. This document and its contents are proprietary information and products of Morgan Stanley Smith Barney and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required by law. This material does not purport to identify the nature of the specific market or other risks associated with a particular transaction and may contain general advice. General advice is prepared without taking account your objectives, financial situation or needs and because of this, you should, before acting on the general advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs and if the advice relates to the acquisition of a particular financial product for which a Product Disclosure Statement (PDS) is available, you should obtain the PDS relating to the particular product and consider it before making any decision whether to acquire the product. Any decision to purchase the Financial Products should be based solely upon the information in the offering document. Before entering into a transaction, you should ensure that you fully understand the terms of the transaction, relevant risk factors, the nature and extent of your risk of loss, as well as the legal, tax, and accounting consequences of the transaction. You should also carefully evaluate whether the transaction is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances and whether you have the operational resources in place to monitor the associated risks and obligations over the term of the transaction. We recommend that you obtain financial, as well as tax, advice based on your own individual circumstances before making an investment decision. If you make an investment or undertake a transaction through Morgan Stanley Smith Barney, Morgan Stanley Smith Barney or other third parties may receive fees arising from the investment or transaction, which will be disclosed by your financial adviser. The Firm provides a vast array of investment banking and non investment banking financial services to a large number of corporations globally. The reader should assume that the Firm or its affiliates receive compensation for those services from such corporations. The Firm may make a market in any of the Financial Products mentioned in this material and for Financial Products in which the Firm is not a market maker, the Firm usually provides bids and offers and may act as principal in connection with such transactions. The Firm may actively trade these Financial Products for its own account and those of its customers and, at any time, may have a long or short position in these or related Financial Products. © 2012 Morgan Stanley Smith Barney Australia Pty Ltd Please ask your financial adviser for additional details. Derivatives: The investment strategies outlined may involve the use of derivatives, including exchange-listed options, which are not suitable for every investor. Investors who buy options may lose the premium if the stock does not move beyond the strike price. If they delta hedge, they may lose money if realised volatility is less than implied volatility paid in the option. Investors who buy options may lose their entire premium. Investors who sell options have unlimited risk. Before entering into any transaction using derivatives, investors should read and understand the applicable risk disclosure documents. |